Articles

METHODOLOGY OF PURGING INTEREST INCOME

1. METHODOLOGY OF PURGING INTEREST INCOME

Mufti Abdul Kadir Barkatullah

S. M. Wasiullah

I. INTRODUCTION

The process of removing interest income from total income is

known as interest purification or purging. It is one of the important

requirements of the Sharīʿah when undertaking Islamic investments.

Purification can be either of interest income only or of different kinds

of impure income.

Interest income is accrued on bank deposits, loans advanced

or interest-based investments. It is reported as ‘Interest Income’

in financial statements of companies. Generally, interest income is

reported as a part of Total Income. The company benefits from the

accrued interest income by utilising it for meeting its costs or expenses

from various operations or for paying dividends and creating reserves.

The investor who owns shares of a company also automatically

becomes morally responsible for the financial transactions of the

company. Hence, to make the investment Sharīʿah compliant, the

investor needs to purge his share of the interest income that has

accrued to the company to the extent of his investment in the shares

of the company.

The aim of this short article is to describe the existing purging

methodologies that are globally practiced and briefly highlight their

shortcomings. It also provides numerical examples of the differentmethods of determining the impure income quantum of the investor

in an attempt to provide clarity on how the purging methodologies

work.

II. EXISTING PURGING METHODOLOGIES

There are two prominent purging methods practiced globally. One

is the dividend-based purging method, and the second is the purging

method suggested by the Accounting and Auditing Organization

for Islamic Financial Institutions (AAOIFI). In view of some of the

shortcomings in these existing methodologies, a third method, which

is a modified version of AAOIFI’s purging method, is adopted by

Taqwaa Advisory and Shariah Investment Solutions (TASIS) Private

Limited—a premier Sharīʿah advisory services provider from India.

The details of these three purging methodologies are provided as

follows.

Under this method, the purging amount is calculated by multiplying the proportion of impure income to total income by the dividend received on the shares of the company held by the investor (e.g., individuals, institutions, or funds).

The formula can be expressed as:

(Interest Income/Total Income)*(Dividend Paid per Share)*(Number of Shares Held)

It can be demonstrated that this method, in effect, leads to the purging of only a small part of the total interest income (from as little as under 5% to about 10% of the total interest income in the best case scenarios), whereas the major part remains in the business or is used to pay for expenses of the business.

Also, in the event a company does not pay a dividend in a particular year, the interest income of that year is not purged at all. Hence, there is no rationale for linking purging to receipt of the dividend.

Moreover, the recipient of the dividend may not even be the holder of the shares during the interest-earning period. It is common knowledge that companies declare dividendsfor a specific accounting period after the end of that period and after the accounts for that period have been produced. For instance, dividends are paid three to six months after the closing of the accounting year of the company. At such point in time, it is very likely that the person holding the shares may not have held any shares for even a single day during the interest-earning period when the violation occurred.

The second method is that of AAOIFI. According to this method, the purging amount is calculated by dividing the total prohibited income by the total number of outstanding shares of the company and then multiplying the resulting figure by the number of shares owned by the investor. Purging under this method is obligatory upon the investor only if the investor holds the shares of the firm at the end of the accounting period. It is not required for those who may have held them during the financial period but exited them before the year-end.

The formula can be written as:

(Interest Income/Total Outstanding Shares)*(No. of Shares Held at Year-end)

Under this method, the entire interest income can be purged. However, there appears to be a tenuous justification for laying the responsibility of purging the interest for the entire year solely and entirely on the person who is found to be holding the shares at the time of closing of the financial year. In fact, doing so constitutes an injustice to the person holding the shares at that time.

The interest income is earned throughout the year and should be the proportionate responsibility of all those who held the shares during the year, to the extent of the duration they held the shares for the respective periods. It should not be the exclusive liability of the one who happens to be holding the shares at the year-end.

In addition to the abovementioned two prominent methods, a modified version of the AAOIFI purging method that is deemed more just and comprehensive is used by Taqwaa Advisory and Shariah Investment Solutions (TASIS) Private Limited. This method requires the purging of impure (interest) income earned per share of a company held by an investor pro-rated over the period for which the investor held those shares in his portfolio. Hence, according to this method, purification of income is imperative for the investor who had the ownership of the company shares when the interest was earned by the company. He needs to donate the pro-rata amount of interest income earned per share by the company for the relevant holding period, irrespective of whether the company or the investor made profits, and whether the company declared dividends or not.

The formula can be written as:

[(Interest Income/Total Outstanding Shares)*(No. of Shares Held)]*[(No. of Days {or Months} the shares were held/Total No. of Days {or Months} in the entire Accounting Period)]

In case the investor needs to purge a portfolio of various shares held, the same method needs to be followed for all the stocks in his portfolio, taking into account the relevant holding periods for the different stocks.

In case of a financial instrument such as a unit of a Sharīʿahcompliantmutualfund or pension fund, the overall interest purification ratio for the portfolio of the fund needs to be calculated on the basis of the portfolio of stocks held under the respective instrument and communicated by the mutual fund to individual holders orsubscribers of the fund/scheme as a ratio (i.e., the purging amount per unit of the security held per day).

The modified AAOIFI method of purification is logical and equitable. It does not contain any loopholes whereby the full purging of the interest income received by the company can be avoided. In fact, under this method, the shortcomings of the other two methods are successfully addressed.

III. NUMERICAL EXAMPLES

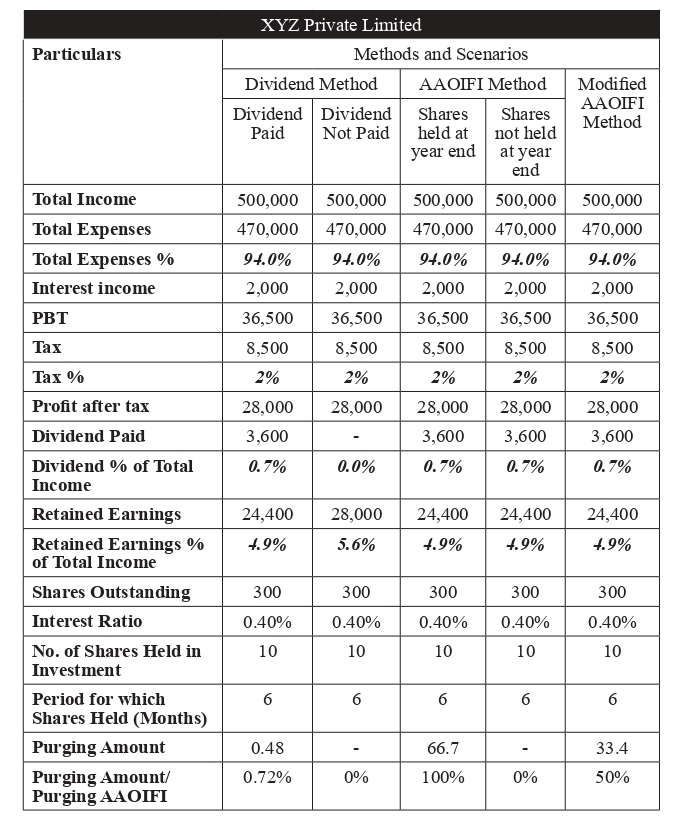

Different scenarios are presented below to clarify how the impure income quantum is determined according to each ofthe three methods. The most general cases are considered here to avoid any confusion.

Let us assume a company, XYZ Private Limited, has Total Income of USD 500,000 million, Total Expenses of USD 470,000 million, Profit before Tax (PBT) of USD 36,500 million, Tax of USD8,500 million and Profit after Tax (PAT) of USD 28,000 million. The Total Interest Income of the company is USD 2,000 million and the Total Outstanding Shares are 300 million. Assume an investor purchases 10 million shares of XYZ Private Limited and holds the same for six months.

The purging amounts are calculated for two different scenarios using the three different methods discussed above.

The first scenario for the dividend-based method is where the Company has paid a dividend of USD 3,600 million. The purging amount can be calculated using the appropriate formula given above:

(Interest Income/Total Income)*(Dividend Paid per Share)*(No. of Shares Held)

Hence,

Purging Amount =

(2,000/500,000)*(3600/300)*(10)

= (0.004)*(12)*(10)

= USD 0.48 million

The second scenario is where the company did not pay any dividend. In this case,since no dividend is paid, there is no amount to be purged:

Purging Amount =

(2,000/500,000)*(0/300)*(10)

= (0.004)*0*(10)

= USD 0 million

In the first scenario for this method, the purging amount is given as per the formula:

(Interest Income/Total Outstanding Shares)*(No. of Shares Held at Year End)

Hence:

Purging Amount =

(2,000/300)*(10)

= (6.67)*(10)

= USD 66.7 million

In the second scenario, the shares are not held by the investor at the end of the period.

Hence:

Purging Amount =

(2,000/300)*(0)

= (6.67)*(0)

= USD 0 million

It means that,since the investor does not own the shares at the end of the year, there will be no purging liability at all on the investor who had held the shares when the interest was received by the company.

Under the modified AAOIFI purging method, the investor needs to purge the interest income for the period during which the shares were held by him. This is irrespective of whether he still held the shares at the end of the financial year and whether a dividend was paid. That means only one scenario is presented for this method.

The formula for the purging amount is:

[(Interest Income/Total Outstanding Shares)*(No. of Shares Held)]*[(No. of Days {or Months} the shares were held/Total No. of Days {or Months} in the entire Accounting Period)]

Since the investor held the shares for six months, then the purging amount can be calculated as:

Purging Amount =

[(2,000/300)*(10)]*[(6/12)]

= [(6.67)*(10)]*[0.5]

= USD 33.35 million

The following table summarises the calculations under the three purging methods.

IV. CONCLUSION

From the above, the following conclusions can be drawn:

a. The total interest received by the company in the example was USD 2,000 million on behalf of its total of 300 million shares. Since the investor owns 10 million shares, his share of the interest is USD 66.7 million. Despite that, using the dividendbased method, the investor is required to purge only an amount of USD 0.48 million, i.e., less than 1% of the interest received by the company on his account. Moreover, this is restricted to the case where the company distributes a dividend.

b. If the company does not declare a dividend, or if it declares a dividend but the investor had already sold his shares earlier, the investor is not required to purge any amount though the interest was earned while he held the shares.

c. Under the AAOIFI method, the investor is required to purge the entire interest amount of USD 66.7 million received by the company on behalf of the shares of the investor, irrespective of whether or not the company declares a dividend.

d. However, this liability becomes his responsibility only if he continued to hold the shares until the end of the accounting period. Otherwise, the same (entire) liability of USD 66.7 million is required to be borne by someone else who was holding the shares at the end of the accounting period. This is so even if they held them for only a fraction of the entire period over which the interest was received.

e. Under the modified AAOIFI method, the investor is required to purge only the (full) amount of interest earned by the company, as represented in the shares held by him, during the period he held the shares. This applies irrespective of whether the company declared a dividend or not and whether he was holding the shares when the company closed its accounting period. The only criterion is how much interest was earned by the company on account of his shares and during the period he held the shares. That is the exact amount he is required to purge.

References

AAOIFI (2015). AAOIFI Shariah Standards. Bahrain: Author. Khatkhatay, M. H., & Nisar, S. (2007). Shariah Compliant Equity Investments: An Assessment of Current Screening Norms. Islamic Economic Studies, 15(1), 47-76. Retrieved from http://www.irti.org/English/Research/ Documents/IES/085.pdf

S&P Dow Jones Indices (n.d.). S&P 500 Shariah. Retrieved from http://www. spindices.com/indices/equity/sp-500-shariah-index

TASIS (P) Limited (n.d.). Handbook on Investments in Shariah Tolerant Stocks. Retrieved from http://tasis.in/userfiles/files/Handbook%20on%20 Investments%20in%20Shariah%20Tolerant%20Stocks.pdf